Проблемы и пути обеспечения финансовой стабильности банковской системы Республики Казахстан

Problems and ways of ensuring financial stability of a banking system of the Republic of Kazakhstan

Авторы

Аннотация

В статье проводится анализ устойчивости банковской системы Республики Казахстан и факторов ее определяющих на основе макропруденциального подхода. Авторами делается вывод, что существующие риски в банковском секторе подтверждают необходимость дальнейшего совершенствования направлений и мер преодоления кризисных явлений, укрепления устойчивости банковской системы. В качестве данных направлений предложены: решение проблемы просроченных кредитов, докапитализация банковской системы, расширение ресурсной базы отечественных банков, совершенствование взаимоотношений заёмщиков и кредиторов, совершенствование риск-менеджмента банков.

Ключевые слова

Республика Казахстан, банковская система, финансовая устойчивость банковской системы, макропруденциальный анализ

Рекомендуемая ссылка

Проблемы и пути обеспечения финансовой стабильности банковской системы Республики Казахстан// Региональная экономика и управление: электронный научный журнал. ISSN 1999-2645. — №1 (49). Номер статьи: 4927. Дата публикации: 23.02.2017. Режим доступа: https://eee-region.ru/article/4927/

Authors

Abstract

In the article the analysis of a banking system stability of the Republic of Kazakhstan and factors defining it on the basis of macroprudential approach is carried out. Authors draw a conclusion that the existing risks in the banking sector confirm the need of further improvement of the directions and measures of overcoming of the crisis phenomena, strengthening of stability of a banking system. As this directions are offered: solution of the problem of credits’ overdue, recapitalization of a banking system, expansion of domestic banks’ resource base, improvement of relationship between borrowers and creditors, improvement of a banks’ risk management.

Keywords

Republic of Kazakhstan, banking system, financial stability of a banking system, macroprudential analysis

Suggested Citation

Problems and ways of ensuring financial stability of a banking system of the Republic of Kazakhstan// Regional economy and management: electronic scientific journal. ISSN 1999-2645. — №1 (49). Art. #4927. Date issued: 23.02.2017. Available at: https://eee-region.ru/article/4927/

Introduction

Actual problem of the modern world is financial stability in which providing the special role is played by a sustainable development of economy and its major link — a banking system. As it is stated by Bossone, banks provide the raw material for a monetary production economy to work and grow (regardless of the technological form of money). He emphasized, that the positive impact of finance on economic growth has received significant empirical support during the nineties, starting with the contribution by King and Levine (1993). Research showed also that countries with more developed banking systems and liquid capital markets have experienced the most rapid growth (Demirgüç-Kunt and Levine, 1996), confirming the importance of complementarity between banking and nonbank financial intermediation [1].

National interests of the state in the financial sphere demand formation of an independent, competitive, stable, steady and reliable banking system capable to carry out its functions and to develop both in favourable economic conditions as well as in crisis period.

As Trapanese pointed out, in recent years, policy-makers and banking supervisory authorities reinforced their efforts aimed at ensuring financial stability, considering it as a relevant policy objective, autonomous with respect to both monetary and microeconomic stability. Many central banks regularly publish reports in which they disclose their assessment in order to discuss the implications for financial stability of globalization, financial innovation and macroeconomic fluctuations [2].

It is worth noting that, there are a number of researches dedicated to investigation of peculiarities of financial stability in emerging markets. Research, done by BIS, show that, macroeconomic vulnerabilities (particularly to external shocks) appear to have declined, reflecting a mix of favourable temporary conditions as well as improved policies (higher foreign reserves, more flexible exchange rates, domestic debt market development and improved fiscal policies). However, some central banks were still concerned about vulnerability to certain shocks (eg to domestic demand, to increases in oil prices or interest rates or declines in property prices), particularly given the exposure of banks to interest rate or exchange rate risk and the need in some countries for further fiscal consolidation [2-3].

Kazakhstan is an emerging market in Central Asia. The main share in the general size of a financial system of the Republic of Kazakhstan is the share of banking system, the second-large is the budgetary system, the third-large share is securities and investments market and the fourth one is the insurance market. Therefore, the banking sector is a key component of the financial system of Republic of Kazakhstan.

The continuing decrease in the world price for oil, and also reduction of physical volumes of oil, coal, ferroalloys, copper and aluminium export negatively affects GDP growth, reduces the export income and has a negative impact on the income of republican budget and payments balance of the Republic of Kazakhstan.

In these conditions the banking system of the Republic of Kazakhstan again faced serious calls. Devaluation of tenge in February, 2014 and then in the second half of 2015 provoked significant growth in system risks of the Kazakhstan banking sector.

Cyclically repeating crises in the banking sector confirm lack of early response system to the arising negative phenomena in bank activity. Furthermore, as it is stated by, Gorton (2009), a banking panic is a systemic event because the banking system cannot honor commitments and is insolvent. The panic of 2007 appears to have this feature, although the panic happened in the shadow banking system, not the regulated system. Subprime related products were shocked by the decline in housing prices, but the location of these risks was not known. This shock is reminiscent of the 19th century shocks and had the same outcome.

Nowadays problem aspects of prevention and protection of banks against external and internal threats increase the need of use of effective instruments of crisis centres early detection in banking practice and development of mechanisms of credit activity flexible adaptation to new managing conditions. Among them abandon the hold to maturity target purchase price and obtain the trouble assets at a price closer to fair value, do not bail out the financial institutions that are already insolvent by purchasing their assets at a premium price, protect savings and checking deposits of all citizens, establish a Bank Capitalization Fund that would jump start our credit system, and initiate a program to incentivize mortgage cram-downs. So far, policy makers have reacted to one crisis after another [4-5].

According to that it is necessary to refer formation of model of a steady banking system to the number of the major problems of theory and practice. In that case the search of the directions and instruments of overcoming the crisis phenomena, strengthening of stability of a banking system, becomes the major macroeconomic task.

Procedure

The banking system represents difficult and versatile object of research. Sufficient amount of scientific researches is devoted to bank activity research which contain qualitative and quantitative empirical analysis of national banking systems crises and separate banks’ bankruptcies and consider various aspects of bank activity (information streams in activity of banks, an assessment of bank risks, the analysis of solvency of the borrower, distribution of means of commercial bank and others): Poon (1999), Dieter, (1998), Gavin (1998), Miller and Luangaram (1998), and others [6-13].

It is remarkable that the majority of them are prepared in the international financial organizations (the IMF, the World bank) which are engaged in recommendations and practical measures development, directed on overcoming of the crisis phenomena in banking sphere. The following can be attributed to such measures:

- implementation of the macroprudential analysis concept;

- universal introduction in bank activity of stress testing methodology [14].

Macroprudential analysis is based on market and macroeconomic information research. In focus of its attention there are key markets of assets, financial intermediaries, macroeconomic development and potential imbalances. IMF developed «macroprudential indicators» for the macroprudential analysis in 2000 which further were renamed into “financial soundness indicators or FSI”. The purpose of FSI using consists in identification of the risks that menace the stability and the banking sector in general and the most significant groups of banks.

Lately banking system’ stress testing acts as a basis of its crisis management and consists in an assessment of the extent of potential damage from various external and internal factors’ influence: Wilson (1997a,1997b), Boss (2002), Kearns (2004), Virolainen (2004), Lu and Yang (2012) and others [6-13]. Stress testing is carried out as by the separate credit organizations independently, and at the level of banking system of the Republic of Kazakhstan in whole.

The main results of the macroprudential analysis which is carried out by National bank of Kazakhstan in recent years are given in materials of the research presented in the given article. The main analysis techniques were: stress testing, monitoring of a banking system stability, and also calculation of financial stability indicators.

Results

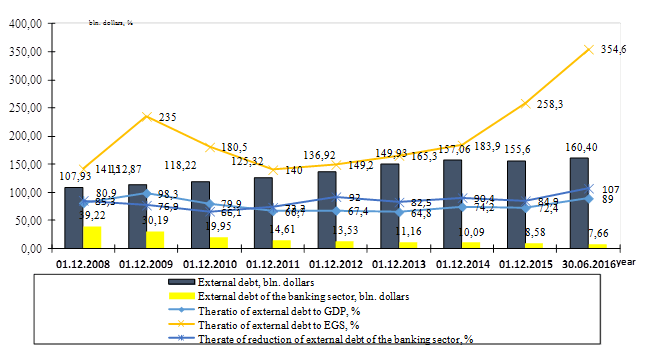

As practice shows, debt problems of the state are the prime reason of crises emergence in a financial system [15]. According to official data, for the end of the II quarter of 2016 the external debt of RK was 160,4 bln. dollars, from which 7,659 bln. dollars (4,8 %) is an external debt of the banking sector. For the considered period the increase in the external debt of RK as in relative as in absolute value is observed. So, for the end of the II quarter of 2016 the ratio of an external debt to GDP was 107 %, and the ratio of an external debt to EGS was 354,6 % [16, National Bank of Kazakhstan]. The situation is aggravated with that the retardation of gross domestic product’s growth and noticeable decrease in export of goods and services (EGS) are observed.

Against an adverse situation in general concerning an external debt the position of the banking sector of RK is a little better than in other sectors. So, the banking sector of RK considerably lowered the debt ratio from 39,22 bln. dollars in 2008 to 7,659 bln. dollars in June, 2016, that is 78 % [16-17, National Bank of Kazakhstan].

According to the data of National Bank of Kazakhstan presented in the table 1, from 2008-2016 there were significant changes among main indicators of a banking system of RK. So, for the studied period these indicators insignificantly rose and for December 1, 2016 amounted into the following values: the ratio of assets to GDP reached the level of 57,9 %; the ratio of the credits to GDP – 35,4 %, the ratio of deposits to GDP – 39,5 %. The increase in bank assets growth is generally provided with consumer crediting which volume grew by 130 % since the beginning of 2011 that is connected mainly with banks short-term funding.

Reduction of banking sector assets in relation to GDP by one third for the considered period speaks about noticeable decrease of banks in economy of Kazakhstan. Decrease in banks assets, and also in issued credits in relation to GDP for several years slowed down the economic growth of the country. So, for the end of 2015 the volume index of GDP decreased and numbered 101,2%, for January-September of 2016 made 100,4 %.

Source – (National Bank of Kazakhstan).

Figure 1. Dynamics of external debt of RK

Table1 – Relative indicators characterizing a role of the banking sector in the economy of Kazakhstan

| Indicators | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 01.12.

2016 |

| The volume index of GDP of the previous year, % | 103,3 | 101,2 | 107,3 | 107,5 | 105 | 106 | 104,4 | 101,2 | 100,4* |

| The growth rate of assets of second level banks, % | 102 | 97,2 | 104,1 | 106,5 | 108,2 | 111,4 | 118 | 124,1 | 132 |

| The ratio of assets to GDP, % | 74,13 | 67,94 | 55,18 | 46,91 | 45, 8 | 45,1 | 47,1 | 54,8 | 57,9 |

| Credits of second level banks to GDP, % | 46,5 | 44,9 | 34,8 | 31,8 | 32,8 | 33,1 | 31,8 | 36,4 | 35,4 |

| The ratio of deposits to GDP, % | 28,6 | 35,7 | 31,3 | 28,3 | 28,1 | 28,8 | 29,8 | 36,2 | 39,5 |

Note: *– data for January-September 2016.

Source – ( National Bank of Kazakhstan).

Stability of the banking sector is characterized by the following indicators’ value: capital sufficiency coefficients, liquidity, highly liquid assets share, banking sector profitability indicators which are presented in the table 2.

Table 2. Indicators of the financial stability of the banking system

| Indicators | Threshold value | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| Capital adequacy ratio (First level) (k1-1), % | 5 | 11,4 | 11,6 | 11 | 11 | 12,8 | 13,5 |

| Capital adequacy ratio k1-2, % | 6 | 12,9 | 13,6 | 13,5 | 13,2 | 13,5 | 14,1 |

| Capital adequacy ratio k2, % | 7,5 | 17,4 | 18,1 | 18,7 | 17,3 | 16,3 | 16,4 |

| Indicator of a share of overdue loans, % | 30,8 | 29,8 | 31,2 | 23,5 | 9,4 | 7,3 | |

| Established provisions to a loan portfolio, % | 32,1 | 31,9 | 34,8 | 25,2 | 11 | 10,3 | |

| Net income (loss), bln tenge | Negative Value | -37,6 | 222,1 | 261,2 | 280 | 210 | 387 |

| Return on assets (ROA), % | Negative value | -0,1 | 1,88 | 1,77 | 1,64 | 1,99 | 1,64 |

| Return on equity (ROE), % | Negative value | -1 | 28,11 | 13,2 | 13,17 | 15,9 | 15,2 |

| Net interest margin, % | Negative value | 3,8 | 4,2 | 5,6 | 5,39 | 5,63 | 4,64 |

| Net spread, % | Negative value | 1,6 | 2,1 | 2,8 | 2,69 | 4,48 | 3,92 |

| Quick ratio k4–1 (up to 7 days), % | 1 | 6,874 | 5,033 | 5,21 | 4,119 | 6,021 | 6,564 |

| Quick ratio k4–2 (up to 1 month), % | 0,9 | 3,396 | 2,944 | 2,992 | 2,942 | 3,462 | 3,647 |

| Quick ratio k4–1 (up to 3 months), % | 0,8 | 2,444 | 2,206 | 2,254 | 2,305 | 2,164 | 2,283 |

| Current ratio (k4), % | 0,3 | 0,927 | 0,803 | 0,901 | 0,924 | 1,18 | 1,3 |

Source: (National Bank of Kazakhstan).

In general for the end of 2016 the state of capital sufficiency in the banking system of RK doesn’t cause serious fears. Standard average value is at rather high level, but at the same time, capital distribution is not uniform, and in the banking system the recapitalization is needed for certain banks.

The Kazakhstan banking sector’ liquidity state since the end of 2011 slightly worsened, dynamics of liquidity coefficient change shows their compliance to standard indicators, but there was observed the decrease in separate indicators in 2012-2014 in relation to 2011. In 2016 banking sector liquidity is being stabilized at the low levels. So, quick ratio coefficient up to 1 month increased by 5 points, quick ratio coefficient up to 7 days increased by 9 points in relation to previous year. Stable growth of a banks clients’ deposit base continues to remain the main source of banking sector liquidity, however, in the conditions of increasing economic demand for credit resources banks lack for long-term funding and as a result it leads to the deficiency of long-term liquidity.

According to the results of financial activity for the considered period the banking sector is in a positive zone. Dynamics of profitability of the banking sector of RK shows the income growth of the banking sector in an absolute value, however relative indicators of profitability evidence about the decrease in efficiency of using their own capital by banks and about assets profitability reduction.

Results of the analysis showed that today there are following problems in ensuring banking system stability in Republic of Kazakhstan:

- insignificant banks assets and credit portfolio growth because of weak economic activity of the enterprises and their inability to qualitatively serve credit obligations;

- external sources of funding for the Kazakhstan banks are limited, and resources of domestic market aren’t enough. For the analyzed period domestic market became the main source of credit resources for domestic banks;

- the deposit base of banks remains unstable though during recent years there was observed a significant growth in population deposits, due to the increase of the maximum amount of deposits compensation by Deposit insurance fund;

- credit portfolio poor quality of second level banks, high specific weight of hopeless assets of banks in their general structure;

- overdue arrears and reserves growth reduce the banks’ capital that limits the possibility of crediting and causes noncompliance with the capital sufficiency standard;

- low liquidity of the Kazakhstan financial instruments;

- insufficiency and inefficient use of funding means;

- lack of effectiveness of risk management system.

Besides, the increase in share of idle loans, non-optimal assets structure and insufficient level of domestic banks funding can cause sharp recession of real level of banks’ profitability.

Discussions

Critical evaluation of the banking sector current state in RK allowed to define the main directions of banking sector stability ensuring:

- solution of «bad» credits problem;

- recapitalization of the banking system;

- expansion of domestic banks’ resource base;

- improvement of relationship between borrowers and creditors;

- improvement of banks’ risk management.

The question of overdue arrears remains difficult and in the absence of the complex decision can entail system destabilization. It should be noted that in 2015 National Bank of Kazakhstan took a serious step towards support of debtors banks. So, according to amendments to the banking legislation of RK, the order of repayment of debt to banks was changed. First of all the sums of debt by a principal debt, further by an added remuneration and only after that, the added penalties (penalty) are paid.

Streamlining of problem assets market is possible by means of such measures:

- formation of a uniform system of problem assets classification and providing their withdrawal by means of the state from balance of banks. Creation of a uniform platform for trading them;

- solution of the saved-up «bad» debts and providing in the future of risk insurance connected with change of market condition on the basis of system of bank assets insurance. In the international practice on problem assets systems of bank assets insurance are created.

The system IBA (insurance of bank assets) is voluntary. Any financial institution having the license of the Central bank has the right to submit the application for the accession to system of IBA;

- creation and implementation of the program of repayment by the state of «bad» debts and increase of the possibility of the credit organizations for crediting of economy on reasonable conditions and on available rates;

- carrying out the analysis of the reasons of problems’ emergence in banks which got under procedure of sanitation or revocation of license due to financing of owners’ business;

- introduction of the increased risk coefficients at calculation of capital sufficiency for some types of assets: on the credits issued for purchasing of securities, for granting loans to the third parties, for the credits to the offshore companies, etc.;

- formation of account (registration) uniform system of a personal estate pledge, creation of the mechanism of obligatory debtors’ property arrest in claims of banks, input of the simplified order of judicial review.

Growth of capitalization of the credit organizations assumes development of the following directions: banks reorganization in the form of merges and accessions, growth of the subordinated credits, the preferential taxation of profit in case of its recapitalization.

Reorganization in the form of accession and merge will expand resource base and will increase bank service quality as legal entities as individuals in RK. It will allow to provide uniform credit resources distribution and to provide liquidity of the credit organizations at the sufficient level.

Stimulation of banks owners to recapitalization of profit by the preferential taxation is provided with the following measures: introduction of an income tax zero rate in case of its reinvestment to bank’s own capital, release from the taxation of the investors’ part of profit directed on formation of banks’ authorized capital, legislative simplification of banks’ capital regulation;

Expansion of resource base of commercial banks possibly due to development of flexible system of rates in deposits of individuals and legal entities, creation of institute of «really» urgent deposits, increase in the size of guarantees on deposits of individuals, insurance of legal entities’ means in banks.

Creation of institute of «really» urgent deposits is provided on a basis of:

- introductions of discounts at early withdrawal of long-term deposits;

- introductions of a temporary log at early withdrawal of a long-term deposit;

- ensuring the right of the investor for automatic credit receiving under the ensuring of the long-term deposit on the current interest rate;

- legislative fixing of the possibility of irrevocable deposits opening.

Improvement of relationship between borrowers and creditors, in our opinion, demands decisions from both participants of business deal, namely:

- stimulation of credits’ restructuring;

- expansion of policy of the state support of borrowers for prevention from their possible bankruptcy.

Stimulation of credits’ restructuring. Taking into account the predicted long (3–4 years) restoration of the enterprises’ economic situation, it is necessary to improve mechanisms of loan debt problem management, having added them with measures of National Bank of Kazakhstan for creditors and conscientious debtors’ stimulation to its restructuring.

In our opinion, unavailability of banks to restructure debt considerably is caused by distinction of different creditors’ approaches to possible conditions of debt restructuring, and also need of formation of the raised reserves for possible losses according to requirements of NB RK.

In this connection it is obviously necessary to stimulate banks to carrying out restructuring of debt on an initiative of conscientious debtors on the certain standardized conditions by means of specification of NB RK regulations. The main thing of them is development of the plan (program) of financial improvement of the enterprise (for 2-3 years) by the debtor coordinated by creditors which includes actions for restructuring of overdue and urgent debt, and also a condition of receiving new loans.

The recommended standards of agreements of creditors with the debtor and plans of financial improvement could be offered by NB RK in the form of annexes to the relevant regulations. Existence of the plan of the financial improvement coordinated with most of creditors its compliance to the recommended standard and the confirmed actual execution could be considered by the credit organization and supervisory body as the factor reducing the level of credit risk and, respectively, allowing not to demand from banks the formation of the raised reserves, in coordination with possibility of granting new credits (without deterioration of quality assessment).

The standard of restructuring of problem debt set thus would establish approaches, uniform for all creditors, defining the general requirements to structure and contents of plans for financial improvement of the enterprises, and guaranteed them confidence that all participants of restructuring will adhere to jointly reached and documentary fixed agreements. These measures will allow the credit organizations to use more effectively pre-judicial methods of regulation of problem debt in relation to conscientious debtors on the approaches accepted in the international practice in «clubs of creditors» without resorting to bankruptcy procedure which, as practice shows, is inefficient for creditors in a situation of mass insolvency of debtors.

One of the reasons of the crisis phenomena in a banking system of RK became weakness of a risk management in banks and insufficient development of methodical approaches to management of bank processes.

Risk management system in many respects continues to be formal; its full independence isn’t provided. Separate thematic blocks of a risk management are often not integrated into an integral and steady control system that leads to the incomplete accounting of risks and making the incorrect administrative decisions. Attention wasn’t paid to many crucial aspects (for example, to reputation risks, quality management of business processes, technical supervision).

At the moment ways of legislative toughening of risk management systems in a financial system are actively discussed, including the international level. Bank community and, first of all, owners of banks have to take active measures for creation and introduction of more complete principles of risk management. It is possible to note the following directions of risks control system improvement:

- increase of the status and powers of risk management services heads;

- improvement of personnel preparation quality which is carrying out a risk management;

- development of internal procedures of a risk management taking into account modern requirements, giving them the status of public;

- assessment of banks’ managerial effectiveness taking into account not only profitability of business, but also influence of risks and size of the prevented losses;

- improvement of systems of internal control and reporting;

- introduction of a forecasting scenario and development of bank acting plan for a case of emergency situations;

- development of policies on risk management in informational, reputational, technological and other spheres of banking business;

- expansion of tools on liquidity maintenance, including introduction of countercyclical banking products.

Conclusion

The problem of ensuring financial stability of the banking system causes the solution of a complex of tasks: increasing of level of capitalization and quality of assets of bank, formation of conditions of injection of a banking capital in real economy, availability of long-term sources of funding of banks.

The offered measures are urged to solve some structural problems, typical for the Kazakhstan banking sector, and to provide to the regulator and participants of the financial market necessary conditions and effective tools of ensuring financial stability.

List of References

- Boss M. (2002). A Macroeconomic Credit Risk Model for Stress Testing the Austrian Credit Portfolio. Financial Stability Report, (4), 64–82.

- Basel Committee on Banking Supervision. Range of practices and issues in economic capital frameworks. – March 2009/ / www.bis.org

- Basel Committee on Banking Supervision. Consultative Document: Principles for effective risk data aggregation and risk reporting. — June 2012 // www.bis.org

- Enhancing Financial Stability and Resilience: Macroprudential Policy, Tools, and Systems for the Future. Group of Thirty, October 2010

- Macroprudential instruments and frameworks: a stocktaking of issues and experiences. CGFS Publications No38, May 2010

- Poon, S. (1999). Malaysia and the Asian Financial Crisis: A View from the Finance Perspective. African Finance Journal, Special Issue 1999

- Lu, W., Yang, Zh. (2012). Stress Testing of Commercial Banks’ Exposure to Credit Risk: A Study Based on Write-off Nonperforming Loans, Asian Social Science Vol. 8, No. 10;

- Wilson T. C. (1997a). Portfolio Credit Risk I. Risk, 9(10), 111-117.

- Virolainen, K. (2004). Macro Stress-Testing with a Macroeconomic Credit Risk Model for Finland. Bank of Finland Discussion Paper.

- Allan Kearns. (2004). Loan Losses and the Macro economy: A Framework for Stress Testing Credit Institutions’. Financial Well-Bein. Financial Stability Report, 111-121.

- Schinasi G. J.Defining Financial Stability. IMF Working Paper. WP/04/187. October 2004. P.13.

- Ferguson R.W.Should Financial Stability Be an Explicit Sentral Bank Objective? Wash.: Federal Reserve Board, 2002. P. 2

- Stability of a banking system and development of bank policy: monograph / team of authors; edited by. O.I. Lavrushina. – M. : KNORUS, 2014. – 280 p.

- The Financial Sector Assessment Program // International Monetary Fund imf.org/external/np/fsap/fsap.aspx (September 21, 2015)

- Eskindarov M. A. Russian financial system stability: assessment indicators and criteria // «Bulletin of Financial University»№ 2 (68) 2012. – P.8-19

- Payment balance and external debt of the Republic of Kazakhstan for December 1, 2016: // National Bank of Kazakhstan.

- The report on financial stability of Kazakhstan for 2015 // www.nationalbank.kz

- Current state of the banking sector of RK for December 1, 2016: // National Bank of Kazakhstan

- The project of the Concept of development of financial sector of RK till 2030 (financial concept 2030) // www.nationalbank.kz

- The memorandum concerning financial stability between the Government of RK and National Bank of Kazakhstan // http://www.nationalbank.kz

Еще в рубриках

Казахстан

Мировая экономика